As a data governance professional, I am frequently asked if master data management (MDM) should be incorporated into an overall data governance strategy. The answer is absolutely YES.

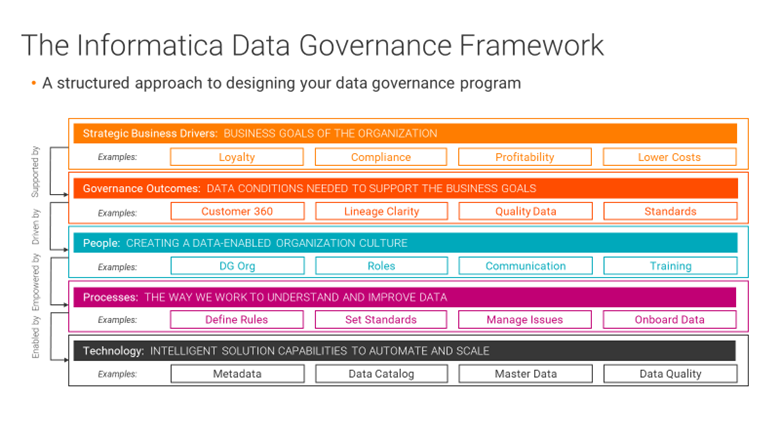

Informatica’s data governance framework (and most industry-standard data governance frameworks) identifies master data as a main component to an overall data governance program.

The Informatica Master Data and Master Data Management Overview Guide describes the difference between Master Data and Master Data Management.

Master data is a collection of common, core entities along with their attributes and their values that are considered critical to a company's business, and that are required for use in two or more systems or business processes. Examples of master data include customer, product, employee, supplier, and location data. Complexity arises from the fact that master data is often strewn across many channels and applications within an organization, invariably containing duplicate and conflicting data.

Master Data Management (MDM) is the controlled process by which the master data is created and maintained as the system of record for the enterprise. MDM is implemented in order to ensure that the master data is validated as correct, consistent, and complete. Optionally, MDM can be implemented to ensure that Master Data is circulated in context for consumption by internal or external business processes, applications, or users.

Ultimately, MDM is deployed as part of the broader data governance program that involves a combination of technology, people, policy, and process.

Incorporating MDM into the Data Governance Operating Model:

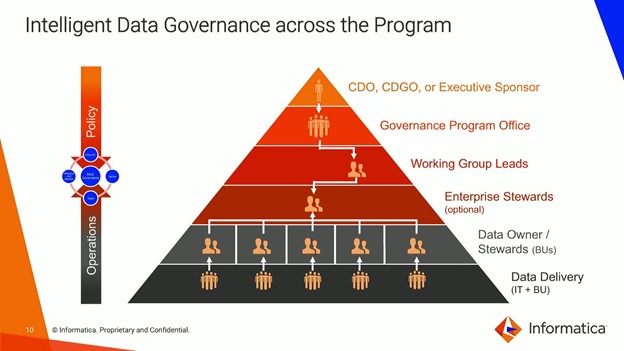

There are several approaches to incorporating MDM into the data governance operating model. In the example below, the data owner or steward of a specific business unit has the authority to make decisions related to their data. Typically, the data owner can make the most informed decision regarding domain-specific data.

Additionally, MDM exception reporting, along with effective and consistent change management processes, provide visibility to the business about gaps in existing workflows or processes, and enable the business to make changes at the source, ultimately improving data quality (another key component of a data governance program).

In the case study below, we will review how Heartland Financial USA, Inc. (now HTLF), leveraged MDM and Data Governance to empower their business users to get the most value from their data.

Case study: Heartland Financial USA, Inc.

The goal: To become customer-centric “top-down” vs account-centric “bottom-up.”

The opportunity: Heartland Financial USA, Inc. identified an opportunity to improve customer experience by changing the way they view and manage their customer information.

The challenge: HTLF business users had relied heavily on managing customers at the account level. This view of the customer was not always complete, as customers can interact in multiple ways within the banking system. Tracking and managing customer “changes” presented another significant challenge to the organization.

Background: Customer information is collected and stored in various disparate systems; this makes it difficult to view the customer from a single view perspective. A customer can 1) have multiple accounts, 2) leverage multiple services across various product lines, and 3) have multiple related parties and relationships at the profile and account level.

This is normal behavior for a customer, but not necessarily the normal workflow for the systems that collect and store related and critical customer information in different source systems.

To get a complete view of the customer, HTLF business users were tasked with developing code to match/merge customer/account data across various systems. The process of matching and merging had its challenges. Not only were end users spending enormous amounts of time on data "wrangling" activities, but the quality of the analytics was also questionable due to the number of systems being merged, and the amount of manual intervention required.

Additionally, the manual process did not provide insight into potential challenges related to business processes that might have been causing the data quality issues, making it difficult to identify and fix recurring issues.

Further complicating the situation: there was no initial data quality done on key matching data such as address and name standardization, causing reduced matching ability and lacking data quality overall.

The solution and approach to enabling MDM and data governance: Patrick Terry, Heartland Financial SVP/CDO and Head of Enterprise Data and Analytics, determined that mastering customer data was a priority for enabling HTLF to become customer centric. Patrick needed to move quickly to solve the householding and match/merging challenges facing his organization. He needed to provide immediate value to end users by:

- providing a clean, single source of truth for customer data (reducing data wrangling).

- enabling business users to identify and correct business process challenges related to data entry/processing customer data.

- generating better insight into customer data by enabling a complete 360-degree view of the customer.

A proponent of data governance, Patrick was aware of the importance of enabling data governance and MDM together to maximize the investment. Per Patrick, “MDM is the execution part of governance and data governance is the enabler.” Patrick determined that the Informatica Customer 360 and Data Quality engine products would be the best fit for his organization based on capabilities, functionality, and business alignment to Informatica.

In parallel to the MDM implementation, Patrick and his team developed an enterprise strategy to enable a data governance operating model to support the associated pillars of people, processes, technology, and data.

The data governance operating model will include a process to manage the MDM workflow through ownership assignment and process definition.

What’s next: Patrick and his team are in the process of establishing a data governance operating model within a specific business unit. They will work with the business unit to define process and workflow and pilot the overall program as well as planning to master other critical data domains and organizational hierarchies.

Need help driving value, building a roadmap, or designing your data strategy, program, and processes? Contact Informatica’s Advisory Services group for an initial consultation.

Read the full blog and view the accompanying images here.